40+ Mortgage refinance break even calculator

There are a few important aspects of a split home loan. Check out the webs best free mortgage calculator to save money on your home loan today.

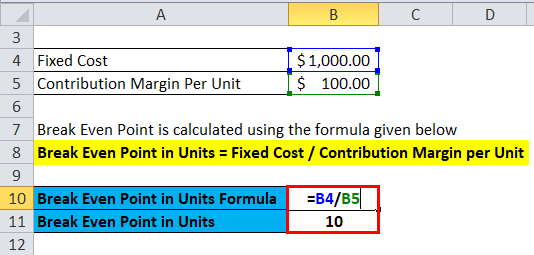

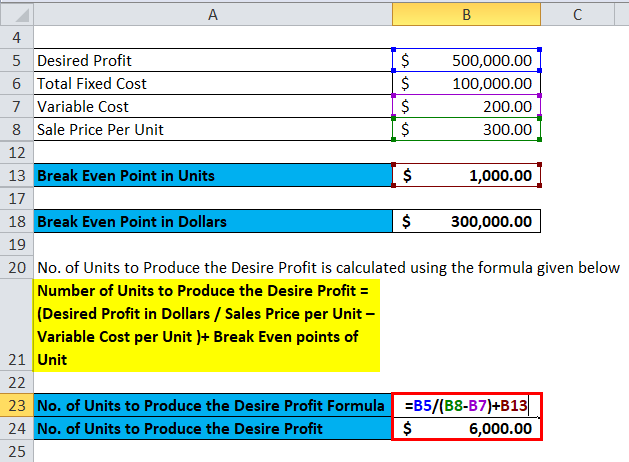

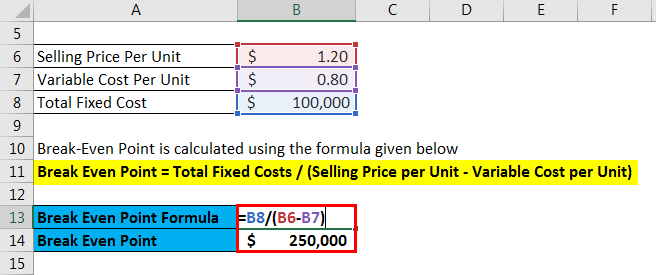

Break Even Analysis Formula Calculator Excel Template

Also offers loan performance graphs biweekly savings comparisons and easy to print amortization schedules.

. It will take you 40 months to break even 8000 divided by 200. Refinance Break Even Calculator Refinancing Closing Costs Calculator Mortgage Recast Calculator. Refinance Break-Even Calculator.

For example if it takes 68 months to hit your break-even point you would have a little more than 24 years left on a 30-year mortgage. For example lets say your new monthly payment will be 200 lower. Find a break-even calculator to see when that 750 cost would be recouped.

The Mortgage Refinance Process. 425 to see how many. New York City Yonkers and several other cities also impose a local tax on mortgages in those jurisdictions.

For a 200000 mortgage refinance for example your closing costs could run 4000 to 10000. Does Refinancing Hurt Your Credit Score. Lenders Mortgage Insurance LMI varies.

You may invest in a stock and for each of 5 years see different growth rates for example the market value of your stock may go up by 5 or 10 percent in some years but only 1 or 2 percent or even lose value in others but the CAGR for that investment will show what you effectively earned in growth per year over that time. Forbes Advisors Mortgage Calculator uses home price down payment and other loan details to give you an estimate calculation on your monthly mortgage payments. The land mortgage calculator returns the payoff date total payment and total interest payment for your mortgage.

Refinance your existing mortgage to lower your monthly payments pay off your loan sooner or. An insurance policy that covers the lender not the borrower against the risk that youll default on your mortgage repayments. Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current loan rates more.

Enter your current loan new loan home and payment information to calculate how much you could save over the long term. The way you structure it is up to you. To figure out your break-even period divide the closing costs by your monthly savings.

In that situation if you think youll be moving in three years it could make sense to keep your current mortgage. Using simple math you could take 750 and divide it by the difference between both monthly payments 4375 vs. Refinance Mortgage Calculator- The refinance mortgage calculator shows how much one can save by refinancing an existing mortgage.

Our calculator includes amoritization tables bi-weekly savings. In the examples shown in the table above financing the points would take the break even point from 49 months to 121 months for the loan with 1 point 120 months for the loan with 2 points. Seniors can buy and refinance homes using Social Security income retirement funds and other assets.

If you refinance your new lender could charge you for LMI again if your outstanding loan debt is still more than 80 of the propertys value meaning your deposit or now equity is still under 20. Living in the same home for over 4 years is common so buying points which break even in 4 years is not a bad idea. Enter an amount between -25 and 25.

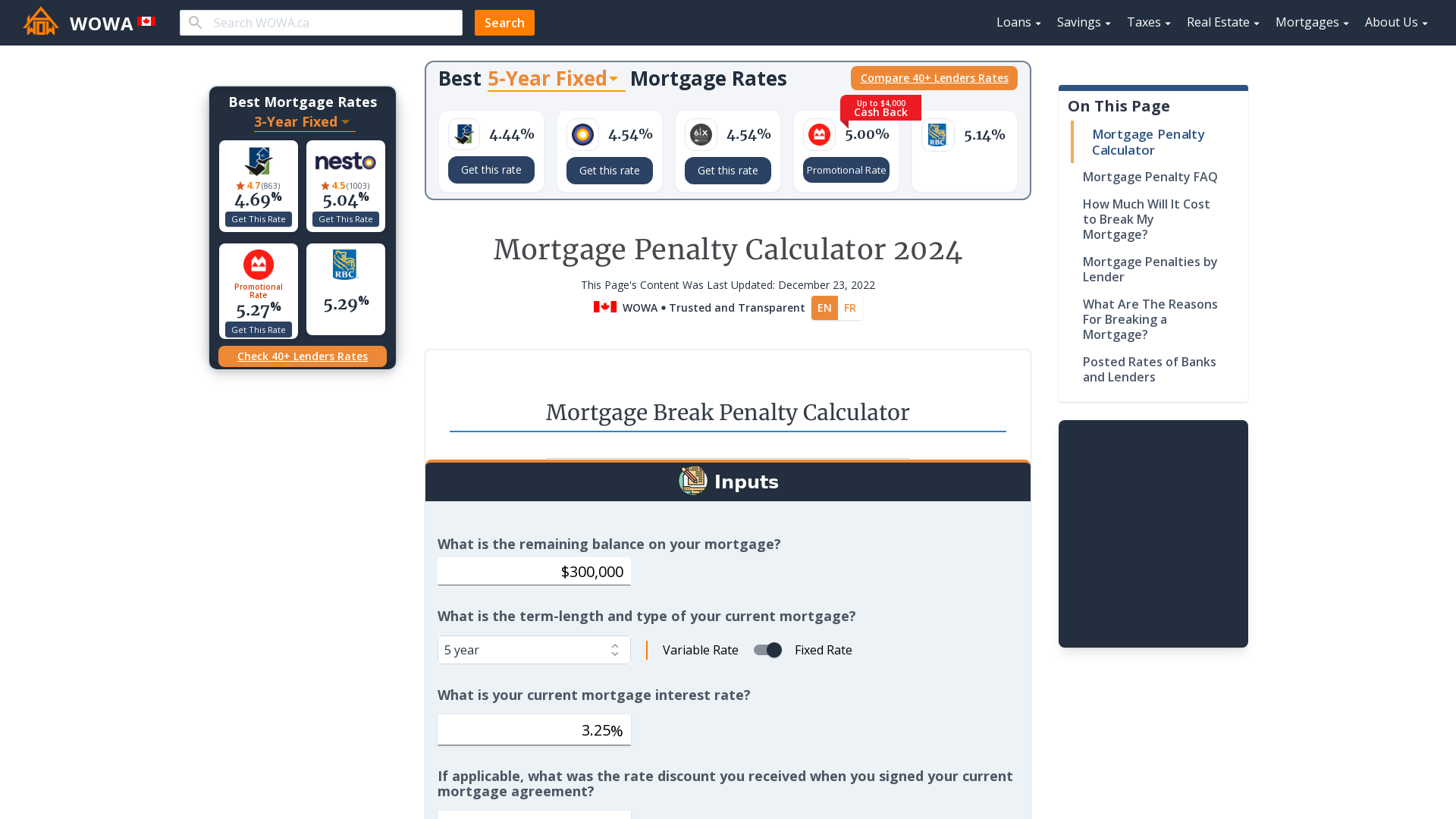

Other things to know about mortgage points The terms around buying points can vary greatly from lender to lender. Our mortgage refinance calculator can help borrowers estimate their new monthly mortgage payments the total costs of refinancing and how long it will take to recoup those costs. This will be the only land payment calculator that you will ever need whether you want to calculate payments for residential or commercial lands.

This entry is Required. Heres a breakdown of the fees commonly included in refinance closing costs. Learn about mortgages for seniors on Social Security.

Explore how taxes fees and more affect costs and your break-even point with this calculator. 18 Reasons to Refinance Your Mortgage. You can choose to split your mortgage 50 fixed and 50 variable or even 60 fixed and 40 variable.

If your existing home loan is on a fixed interest rate you may need to pay a fee to refinance from this arrangement. This mortgage points break-even calculator can help you determine how much youll save each month when youll reach your break-even point and what your interest savings or costs will be for any point in the loan. If the property is located in a city or town that has mortgage tax youll pay an additional 25 to 50 cents.

The split doesnt need to be straight down the middle. The state tax is 50 cents per 100 of mortgage debt plus an additional special tax of 25 cents per 100 of mortgage debt.

Refinance Mortgage Calculator Mls Mortgage Refinance Mortgage Home Refinance Free Mortgage Calculator

Break Even Analysis Formula Calculator Excel Template

Break Even Analysis Formula Calculator Excel Template

Canada Mortgage Refinance Calculator 2022 Wowa Ca

The Ignorance Of People 40 Today You Can T Even Have A Conversation Without Them Gaslighting You Into Thinking The Market Is Affordable For Young People R Canadahousing

Canada Mortgage Refinance Calculator 2022 Wowa Ca

Break Even Analysis Formula Calculator Excel Template

Canada Mortgage Refinance Calculator 2022 Wowa Ca

Refinancing A Mortgage During Covid 19 Ratesdotca

Reverse Mortgage Guide The Truth About Reverse Mortgages

Fbkrro80 Lcsmm

A Href Https Www Mortgagecalculator Org Calculators Should I Refinance Php Img Src Https Www Mo Refinance Mortgage Refinancing Mortgage Home Refinance

Does It Make Sense To Refinance Your Mortgage To 2 25 When Your Current Rate Is 3 And You Plan On Living In That House For A Long Time Quora

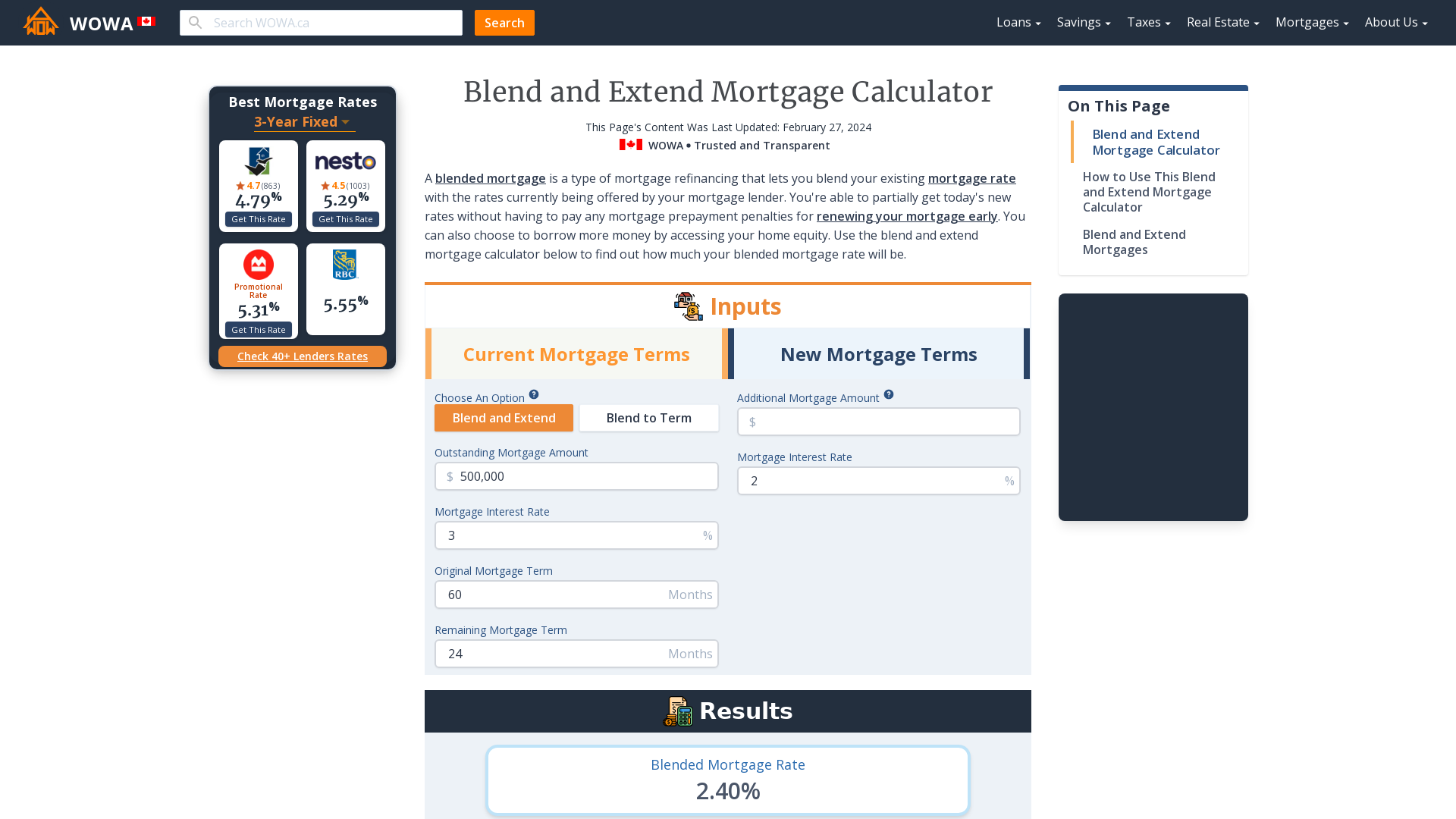

Blend And Extend Mortgage Calculator Wowa Ca

Break Even Analysis Formula Calculator Excel Template

Canada Mortgage Refinance Calculator 2022 Wowa Ca

Lvhhh5sb5j4i0m